Hard Money Atlanta for Beginners

Wiki Article

The Best Guide To Hard Money Atlanta

Table of ContentsFacts About Hard Money Atlanta UncoveredThe 9-Second Trick For Hard Money AtlantaTop Guidelines Of Hard Money AtlantaSome Ideas on Hard Money Atlanta You Should KnowThe 8-Minute Rule for Hard Money Atlanta3 Easy Facts About Hard Money Atlanta Described

These jobs are generally finished swiftly, therefore the demand for fast accessibility to funds. Earnings from the job can be utilized as a down repayment on the following, as a result, difficult money finances permit capitalists to range as well as flip more residential properties per time. Offered that the taking care of to resale time framework is short (usually less than a year), house flippers do not require the lasting finances that typical home loan loan providers offer.

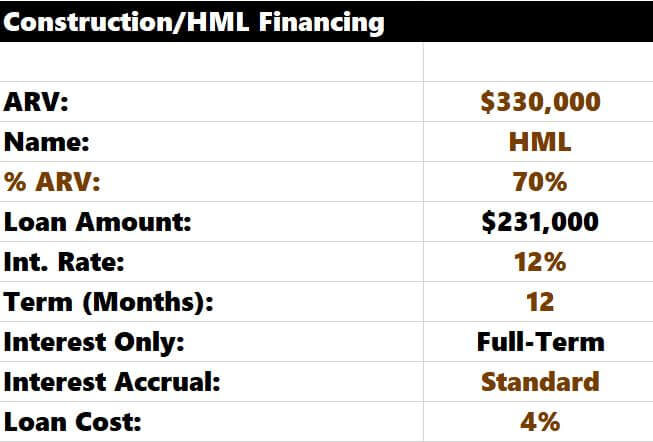

Normally, these elements are not one of the most important factor to consider for car loan credentials. Rather, the worth of the building or asset to be bought, which would certainly also be used as security, is largely thought about. Passion prices may likewise differ based on the loan provider as well as the bargain in question. A lot of lending institutions may charge rate of interest prices ranging from 9% to even 12% or even more.

The Buzz on Hard Money Atlanta

Difficult money loan providers would also bill a charge for giving the loan, as well as these charges are likewise known as "points." They generally wind up being anywhere from 1- 5% of the overall funding sum, however, factors would normally equate to one percentage factor of the financing. The significant difference between a tough money lender and also various other loan providers lies in the authorization process.A hard cash loan provider, on the other hand, concentrates on the asset to be acquired as the top consideration. Credit history scores, income, and also other individual demands come secondary. They likewise vary in terms of simplicity of access to funding and also rate of interest prices; hard cash lenders supply moneying rapidly as well as bill greater rate of interest prices.

You can find one in among the adhering to ways: A straightforward internet search Demand referrals from regional property representatives Request recommendations from investor/ investor teams Since the lendings are non-conforming, you must take your time assessing the requirements as well as terms used prior to making a calculated and notified choice.

What Does Hard Money Atlanta Do?

It is important to run the figures before opting for a hard money lending to guarantee that you do not run into any loss. Request your hard money loan today and also obtain a loan dedication in 24 hrs.A tough money loan is a collateral-backed finance, secured by the real estate being bought. The dimension of the finance is figured out by the estimated worth of the home after proposed repair services are made.

Many tough money lendings have a regard to six to twelve months, although in some circumstances, longer terms can be arranged. The debtor makes a monthly repayment to the lender, normally an interest-only payment. Right here's how a regular hard money loan works: The consumer wants to buy a fixer-upper for $100,000.

Fascination About Hard Money Atlanta

Some loan providers will certainly need even more cash in the offer, and also site ask for a minimum down settlement of 10-20%. It can be advantageous for the financier to seek out the lending institutions that call for marginal down settlement alternatives to reduce their cash to shut. There will certainly additionally be the regular title costs related to shutting a deal.Ensure to get in touch with the difficult money lending institution to see if there are early repayment charges charged or a minimal return they require. Assuming you remain in the finance for 3 months, as well as the building offers for the projected $180,000, the capitalist earns Full Article a profit of $25,000. If the home costs even more than $180,000, the buyer makes also more money.

As a result of the much shorter term and high passion rates, there generally requires to be remodelling and also upside equity to catch, whether its a flip or rental residential or commercial property. Initially, a difficult money finance is optimal for a buyer who intends to repair and also flip an underestimated residential or commercial property within a reasonably short time period.

Hard Money Atlanta Fundamentals Explained

Rather than the regular 2-3 months to shut a traditional home mortgage, a tough money car loan can generally be closed within a matter of a couple of weeks or less. Hard money financings are additionally good for borrowers who may not have W2 jobs or loads of books in the bank.Hard money lenders will lend as much money as the rehabbed residential property deserves. In enhancement, some consumers make use of tough cash loans to bridge the void in between the acquisition of a financial investment residential property as well as the procurement of longer-term financing. hard money atlanta. These buy-and-hold capitalists make use of the tough cash to acquire as well as refurbish buildings that they after that re-finance with traditional lendings as well as manage as rental residential or commercial properties.

All About Hard Money Atlanta

Consumers pay a greater price of interest for a hard money funding due to the fact that they do not need to leap via all the hoops called for by standard lending institutions in addition to getting more funds towards the acquisition rate and improvement. Difficult money loan providers take a look at the property, as well as the consumer's plans to boost the building's worth as well as see it here settle the car loan.When applying for a tough money loan, debtors need to verify that they have enough resources to successfully obtain through a bargain. (ARV) of the building that is, the approximated worth of the residential property after all improvements have actually been made.

Report this wiki page